By Patrick M. Brenner | Southwest Public Policy Institute

Throughout history, antitrust laws have been utilized to protect the process of competition to benefit consumers, making sure there are strong incentives for businesses to operate efficiently, keep prices down, and keep quality up. This is not the case, however, with the looming acquisition of the American-owned Kansas City Southern (KCS) railroad by Canadian Pacific (CP), a foreign-owned company.

If you haven’t heard of this development, then it’s for good reason. While the Biden administration claims that it is concerned about a lack of competition in the rail sector, they are seemingly allowing the potential acquisition to proceed without the same widespread scrutiny other large mergers have triggered. It also appears as if the White House is now willing to abandon the President’s July 2021 executive order “Promoting Competition in the American Economy” which was meant to highlight the importance of healthy market competition and to remove foreign monopolies.

By failing to address challenges associated with our ongoing supply chain crunch, it is as if some within the White House understand that they are not adequately supporting their initial promises to help tame excessive inflation. This is a failure to act in a manner that puts American consumers first.

So what would happen if this acquisition were to be completed without the same types of merger reviews conducted by either the U.S. Department of Justice Antitrust Division or the Federal Trade Commission? Other than reducing the quality of the rail sector in the United States, it would destroy competition.

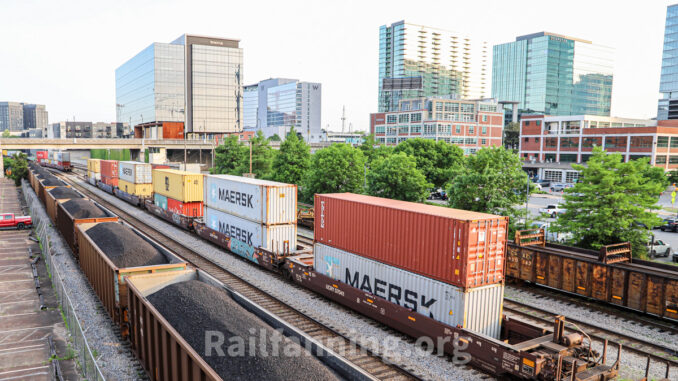

The proposed acquisition would combine the more than 20,000 miles of track in the CP and KCS networks into the only railroad extending service between Mexico, Canada, and the United States, inherently giving the new railroad monopolistic power. Although CP and KCS contend that their companies are end-to-end – servicing different areas with little direct competition – combining the two companies could ultimately allow them to deny service to competitors, cancel reciprocal switching agreements, and close critical gateways. That is especially concerning here in the southwest, where a newly combined CP-KCS railroad would have the incentive to undermine competition at the international rail junction in Laredo, Texas, which is the gateway to 54% of all U.S.-Mexico rail traffic.

Nothing less than the future of rail-reliant American businesses is at stake. Certain commodities and products are already geographically limited. Foreign-owned railroads in control of those routes would leverage even more market power over shippers. This will spike prices in an already troublesome economy. Land-locked states like Minnesota, Montana, and the Dakotas, for example, rely heavily on a single railroad monopoly to move their agricultural products. Already, agriculture inputs are paying twice the rates of areas that have competition. The consequences on business owners and American wallets should this take place are unimaginable.

But the creation of this new railroad would not just adversely affect Americans in their wallets, it could additionally impact Americans in their local communities as well. States like Illinois, Iowa, Missouri, Kansas, Oklahoma, Arkansas, Louisiana, and Texas would see an increase of eight to 14 trains per day. But believe it or not, the noise from these trains would indeed not be the biggest negative of this acquisition.

In a totally expected fashion, there would also be a substantial increase in rail traffic and train length on major rail lines, adding entirely to an issue that already exists in many parts of the country. Hours more of traffic delays are certain, but this may just be a nuisance. More importantly, millions of Americans may have to grapple with potentially life-threatening EMS calls that may not make it to the scene in time. Every second counts on these calls but unfortunately, EMS vehicles, fire or medical, could have to grapple with the gridlock that can result from rail crossings that are blocked for 10 minutes or more when a train is passing through, leading to slower response times.

It is crucial that the Biden administration hold true to its economic and working-class promises. This acquisition will be subsidized and controlled by a foreign entity: a factor worth resisting in and of itself. The Surface Transportation Board must be held accountable and take all public comments, including those who are raising broader economic competition concerns, into consideration. Before a conclusion is reached in early 2023, either the Department of Justice Antitrust Division or the Federal Trade Commission should also consider providing their thoughts on this proposed acquisition.

At this time of uncertainty in the global marketplace, it is imperative to promote competitive and efficient supply chain solutions for the good of American economic security and competitive markets.

Patrick M. Brenner is the founder and president of the Southwest Public Policy Institute, a research institute dedicated to improving the quality of life in the American Southwest by formulating, promoting, and defending sound public policy solutions.