Genesee & Wyoming Inc. is buying Providence and Worcester Railroad Co. for approximately $126 million (or $25 per share).

The deal, which is subject to satisfaction of customary closing conditions, is expected to close following the receipt of P&W shareholder approval in the fourth quarter of 2016.

The deal, which is subject to satisfaction of customary closing conditions, is expected to close following the receipt of P&W shareholder approval in the fourth quarter of 2016.

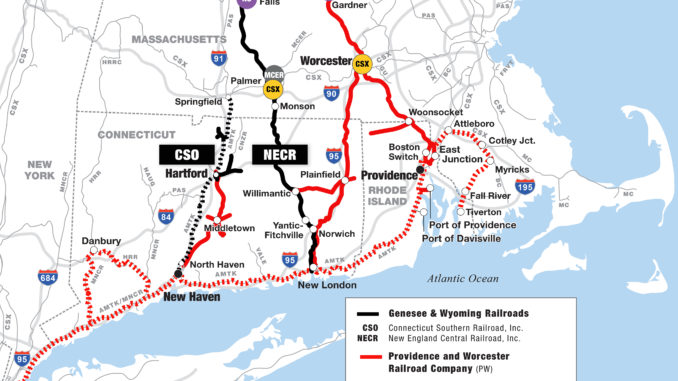

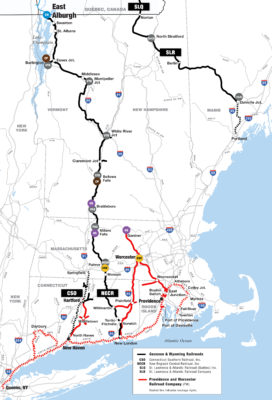

Headquartered in Worcester, Mass., and operating in Rhode Island, Massachusetts, Connecticut and New York, P&W is contiguous with G&W’s New England Central Railroad (NECR) and Connecticut Southern Railroad (CSO). Rail service is provided by roughly 140 P&W employees with 32 locomotives across 163 miles of owned track and over approximately 350 miles under track access agreements.

Agreements include exclusive freight access over Amtrak’s Northeast Corridor between New Haven, Conn., and Providence, R.I., and trackage rights over Metro-North, Amtrak and CSX between New Haven, Conn., and Queens, N.Y. P&W interchanges with G&W’s NECR and CSO railroads, as well as with CSX, Norfolk Southern, Pan Am Railways, Pan Am Southern, the Housatonic Railroad and the New York and Atlantic Railroad, and also connects to Canadian National and Canadian Pacific via NECR.

P&W serves a mix of aggregates, auto, chemicals, metals and lumber customers in southeastern New England, handling approximately 43,000 carloads and intermodal units annually. In addition, P&W provides rail service to three ports (Providence, Davisville and New Haven) and to a U.S. Customs bonded intermodal terminal in Worcester, Mass., that receives inbound intermodal containers for distribution in New England.

P&W also owns approximately 45 acres of undeveloped waterfront land in East Providence, R.I., that was initially created as a deep water, rail served port through a $12 million investment. G&W expects to sell this undeveloped land.

Upon approval by the Surface Transportation Board (STB), P&W would be managed as part of G&W’s Northeast Region, led by Senior Vice President Dave Ebbrecht. The addition of P&W to G&W’s existing presence in the region substantially enhances G&W’s ability to serve customers and Class I partners in New England.

The acquisition is anticipated to unlock significant cost savings through overhead, operational and long-term network efficiencies as well as to generate significant new commercial opportunities, G&W said in a news release.